Zambia’s economic landscape in May 2025 paints a picture of cautious optimism. After months of inflationary pressures and exchange rate volatility, the latest data reveals signs of relief: inflation has eased to 15.3%, the Kwacha has appreciated against the USD, and the equity market is buzzing with activity. Yet beneath these positive trends, structural challenges persist; high living costs, energy deficits, and investor scepticism in the debt market remind us that the road to stability is far from smooth. This report unpacks the nuances of Zambia’s macroeconomic performance, from the shifting tides of inflation and exchange rates to the divergent fortunes of capital markets and the transformative strides in energy policy. For policymakers, investors, and households alike, understanding these dynamics is key to navigating the opportunities and risks ahead.

MACROECONIMIC INDICATORS

Inflation

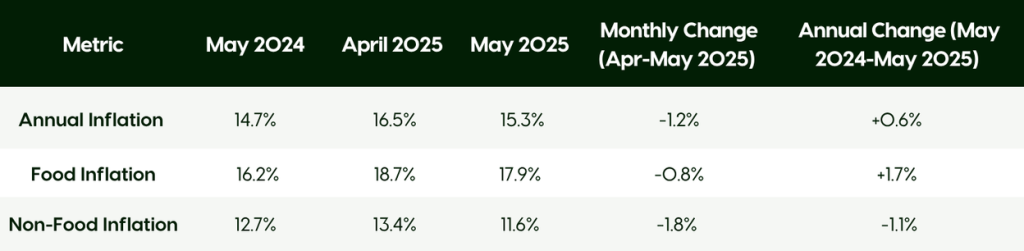

Zambia’s annual inflation rate in May 2025 eased to 15.3%, down from 16.5% in the previous months, marking the lowest level in nearly a year. However, when compared to May 2024, when inflation stood at 14.7%, prices have risen by 0.6 percentage points, showing a 4.08% increase year-on-year. This suggests that while we have observed some relief in the past two months with inflation easing from its peak (16.8%), the overall cost of living remains higher than it was a year ago.

Food inflation, a major concern for households, slowed for the third consecutive month to 17.9% in May 2025, down from 18.7% in April. Improved rainfall has helped boost crop yields, leading to lower prices for staples like maize meal and vegetables. However, food costs are still 1.7% higher than they were in May 2024, meaning many families continue to feel the pinch.

On the other hand, non-food inflation has improved significantly, dropping to 11.6% in May 2025 from 13.4% the previous month. Compared to last year, non-food price increases have actually fallen by 1.1%, providing some relief for expenses like transport, utilities, and services. This slowdown is likely due to stable fuel prices and reduced supply chain disruptions. For consumers, the slight monthly slowdown in inflation (prices rose just 0.3% in May compared to 1% in April) means that while living costs are still rising, the pace is easing. Food remains expensive, but better harvests could lead to further relief in the coming months. Meanwhile, the drop in non-food inflation helps free up household budgets for other essentials.

Lower inflation in Zambia presents several important implications for investors in the local capital markets, including those holding stocks, bonds, and fixed-income instruments. As inflation eases to 15.3% in May 2025 from 16.5% in April, investors may start to see improved real returns on their investments. For stock market participants, declining inflation often signals a more stable economic environment, which can boost corporate earnings and investor confidence. Companies facing lower input costs may see improved profit margins, potentially leading to higher share prices over time. However, the stock market’s reaction may not be immediate, as investors will watch whether this disinflation trend is sustainable.

While inflation remains higher than it was a year ago, the recent slowdown is a positive development for both consumers and businesses. If the trend holds, further easing of price pressures could improve purchasing power and economic confidence in the months ahead. However, risks such as global commodity price fluctuations and exchange rate movements will need to be monitored closely. Overall, the current disinflation trend, if sustained, could gradually shift investment strategies toward growth-oriented assets while making fixed-income investments more appealing in real terms. The key for local investors will be monitoring whether this inflation slowdown translates into lasting monetary policy changes and broader economic stability.

Exchange Rate Trend

In May 2025, the Zambian Kwacha (ZMW) exhibited notable movements against the US Dollar (USD), closing the month at 26.9744 ZMW per USD. This represented a 4.06% appreciation compared to April 2025, when the exchange rate stood at 28.1151 ZMW per USD. On an annual basis, the Kwacha weakened slightly, depreciating by 2.43% from May 2024’s rate of 26.3351 ZMW per USD. These fluctuations reflect underlying economic dynamics, including shifts in commodity prices, monetary policy adjustments, and foreign exchange market conditions. For consumers, a stronger Kwacha in May 2025 brings mixed implications.

On the positive side, imports such as fuel, machinery, and consumer goods, become relatively cheaper, which could help ease inflationary pressures. Given that Zambia is a net importer of essential goods, this exchange rate appreciation may translate into lower prices for households, improving purchasing power. However, exporters, particularly in the mining and agriculture sectors, may face reduced earnings in local currency terms, potentially affecting spending and investment in these critical industries

For investors, the Kwacha’s performance signals both opportunities and risks. The month-on month appreciation suggests improved foreign exchange liquidity, possibly due to higher copper prices (a key export) or increased investor confidence following fiscal reforms. This could make Zambia’s debt and equity markets more attractive to foreign investors seeking higher yields. However, the year-on-year depreciation highlights lingering structural vulnerabilities, such as external debt burdens and reliance on volatile commodity markets. Investors will likely monitor whether the government maintains fiscal discipline and secures positive terms with international creditors, as these factors will determine long-term exchange rate stability.

The Bank of Zambia’s interventions in the forex market may have contributed to the Kwacha’s stability, but external factors, such as global copper demand and USD strength will remain critical drivers. For both consumers and investors, the key takeaway is that while short-term exchange rate gains provide relief, Zambia’s economic outlook still hinges on structural reforms, diversification, and sustained foreign investment inflows.

Basic Needs Basket

The latest Jesuit Centre for Theological Reflection (JCTR) Basic Needs and Nutrition Basket (BNNB) for May 2025 has risen to ZMW 11,272.97, reflecting a ZMW 571.84 increase compared to May 2024. This confirms that living costs remain prohibitively high for most Zambians, particularly the poor and marginalized. While the basket shows a marginal ZMW 145.02 decrease from April 2025, this minor relief does little to alleviate the broader affordability crisis.

The slight dip is largely attributed to seasonal food price fluctuations, with harvest-period crops replacing costlier staples. Similarly, fruit and vegetable prices fell by 13.1% and 7.95% respectively. These shifts demonstrate how seasonal abundance temporarily eases household budgets, yet they also highlight the volatility of Zambia’s food system. Despite this short-term reprieve, structural weaknesses; including poor storage infrastructure, transportation inefficiencies, and post-harvest losses mean prices will likely surge again in lean months. For low-income families, this cycle creates relentless financial pressure, making consistent nutrition and budgeting nearly impossible. The data highlights an urgent need for investment in food preservation, market stabilization, and social protection to break this pattern of scarcity and hardship. While the harvest season brings fleeting relief, sustainable solutions remain critical to securing long-term food and economic justice for all Zambians.

Petroleum Pump Prices

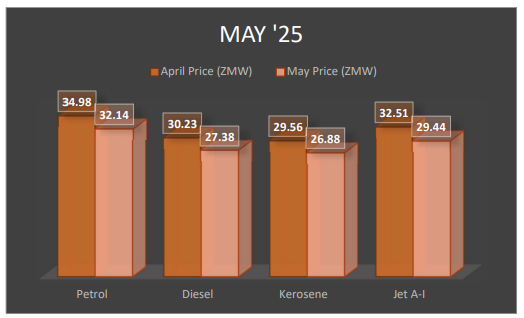

After eighteen months of sustained price pressures, Zambian consumers are finally experiencing meaningful relief at the pumps. The May 2025 fuel price reductions mark the most significant single-month decline since August 2022, with petrol dropping to K32.14 per litre – levels not seen since the third quarter of 2023. This development comes as a dramatic reversal from June 2023’s record high of K35.12 per litre, offering consumers an 8.5% saving compared to 2024’s average prices and bringing costs roughly in line with pre-pandemic levels when adjusted for inflation.

The current pricing landscape reflects a complex interplay of global and local factors. While international crude oil markets have shown relative stability in recent months, Zambia has benefited disproportionately compared to regional neighbors due to its unique pricing mechanisms. Market analysts note this period of relative stability may have broader economic implications.

The transportation sector, which saw operating costs surge by nearly 15% in 2024, now has an opportunity to rebuild margins, while households can redirect fuel savings toward other pressing needs. However, the deeper structural reality remains that Zambia’s fuel pricing system continues to expose the economy to global market whims, underscoring the ongoing need for diversified energy solutions and strategic fuel reserves to buffer against future shocks.

CAPITAL MARKET PERFORMANCE

Equity Market

The Zambian capital market exhibited mixed performance in May 2025, with notable activity in both equities and bonds. The Lusaka Securities Exchange (LuSE) All Share Index (LASI) closed the month at 18,808.51 points, marking a significant increase of 12.97% from April 2025. This upward movement reflects improved investor confidence, particularly in key sectors such as telecommunications, energy, and manufacturing. The market capitalization also saw a robust rise, reaching K289.77 billion (including Shoprite Holdings) and K99.70 billion (excluding Shoprite Holdings), representing increases of 14.75% and 3.34%, respectively, from the previous month. Shoprite Holdings, being dual listed, continued to dominate the market cap due to its substantial weighting.

Trading activity on the LuSE was led by Zanaco, which recorded the highest number of trades (1,335) and the largest turnover (K12.98 billion). Other actively traded stocks included Copperbelt Energy Corporation Plc (CECZ) with 897 trades and a turnover of K12.00 billion, and Chilanga Cement Plc (CHIL) with 318 trades and a turnover of K13.31 billion. These stocks were favored by investors, likely due to their strong fundamentals and sectoral performance. In contrast, smaller-cap stocks like Zambia Bata Shoe Company (BATA) and British American Tobacco Zambia (BATZ) saw minimal activity in comparison, reflecting investor preference for liquid and high-performing equities.

Share price movements were largely positive, with Airtel Networks Zambia Plc (ATEL) closing at K93.91, up by 4.41% from April, and ZCCM Investments Holdings Plc (ZCCM) maintaining a steady price of K100.00. However, some stocks like Puma Energy Zambia Plc (PUMA) experienced declines, dropping by 0.20% to K4.80. Dividends were announced by several companies, including: Zambia Reinsurance Plc (ZMRE) final dividend of ZMW 0.056 per share, REIZUSD declared a dividend of ZMW 0.05314 per share Chilanga Cement Plc (CHIL), which offered a dividend of ZMW 2 per share at a yield of 2.20%. These payouts likely contributed to positive investor sentiment, particularly among income focused investors.

Debt Market

Treasury Bills

The Treasury bill market in May 2025 exhibited weakening demand despite stable yields, underscoring investor concerns about negative real returns in a high-inflation environment (15.3%). Between the two May auctions, the 91-day and 182-day T-bill yields remained unchanged at 11.00% and 12.00%, respectively, but subscriptions for the 364-day tenor fell sharply from K1,367.80 million to K965.27 million. This decline suggests that even longer dated instruments, which offered marginally better nominal yields (14.50%), failed to attract sustained interest. Compared to April, the 91-day yield had risen by 100 basis points (from 10.00%), reflecting monetary tightening, yet demand still waned, perhaps a signal that investors were seeking alternatives beyond traditional fixed-income instruments. The liquidity preference shifted toward shorter tenors, but even these saw reduced participation, indicating broader risk aversion and a flight to more inflation-resistant assets.

Government Bonds

The bond market told a similar story of eroding confidence. While yields on key tenors like the 2-year (15.50%) and 10-year (19.00%) bonds held steady between April and May, subscription levels collapsed. April’s auction had seen reduced demand from March, with total bids reaching K5.68 billion against an offered K1.80 billion, driven by aggressive bidding for 5-year and 10- year bonds. By May, however, bids continued their plummet to K1.99 billion, with the 2-year bond attracting just K92.01 million compared to K236.96 million the prior month. This dramatic pullback highlighted investor scepticism about the sustainability of real returns, as even the 10-year bond’s 19.00% yield translated to a mere 3.70% real return after inflation. The flight to longer tenors (e.g., 7-year and 10-year bonds retaining modest demand) suggested a desperate grab for higher nominal yields, but the broader trend revealed a market losing patience with debt instruments that failed to offset inflationary erosion.

Equities vs. Debt: Diverging Fortunes in May 2025

The Lusaka Securities Exchange (LuSE) All Share Index surged 12.97% in May, delivering near-neutral real returns (-2.33% after inflation), far superior to the deeply negative returns of T-bills and the marginal gains of bonds. Stocks like Zanaco and Chilanga Cement, which combined capital appreciation with dividends, drew income-focused investors, while the market’s K46.26 billion turnover underscored its liquidity advantage over the stagnant bond market (K1.80 billion).

In May 2025, Zambia’s equities outperformed debt instruments, with the LuSE All Share Index surging 12.97% and market capitalization growing by 14.75%, fueled by strong corporate earnings and dividend payouts. Conversely, the debt market saw mixed activity: Treasury Bills maintained steady yields, while bonds faced weaker demand in May compared to April, particularly for shorter maturities. Against this backdrop, the equity market emerged as the clear winner. Investors seemingly favoured equities for higher returns and dividends, while debt instruments attracted risk-averse participants seeking stability, albeit at lower yields. This divergence reflected a structural shift in investor behaviour: with inflation stubbornly high, capital flowed toward assets offering growth potential and liquidity, leaving debt instruments, particularly shorter-tenor bonds and T-bills, starved of demand. Going forward, the equity market’s momentum may persist if corporate performance remains robust, but debt instruments could regain appeal if yields adjust to reflect macroeconomic risks more competitively.

Financial Sector

Monetary Policy

The Bank of Zambia maintained the monetary policy rate at 14.5% following its May meeting. This decision came as inflation began to ease, falling from 16.8% earlier in the year to around 16.5% in April. The central bank signalled cautious optimism that inflation would continue to trend downward toward the medium-term target of 6-8%. The tight monetary stance aims to anchor inflation expectations, stabilize the exchange rate, and preserve investor confidence.

Fiscal Position

Zambia recorded a primary budget surplus of 2.9% of GDP in 2024, reflecting efforts to manage spending and improve fiscal discipline. Despite this, debt service costs remain high, absorbing a large share of government revenues. As a result, the government is under pressure to broaden the tax base and enhance revenue collection to ensure that social and capital spending can be maintained without increasing the debt burden.

Business Conditions (Stanbic PMI)

Stanbic Bank’s Purchasing Managers’ Index (PMI) rose to 51.4 in May, marking the strongest improvement in business conditions in two years. The PMI, which surveys private sector activity excluding mining, showed gains in new orders, output, and employment. For businesses, this signals a rebound in demand and growing confidence, which may lead to increased investment and hiring. Investors may interpret the expansion as a sign of strengthening corporate performance and economic momentum. For consumers, rising business activity could support job creation and income growth, though energy shortages and high input costs may still limit price stability in the short term.

IMF Engagement

In May, the International Monetary Fund concluded its mission to Zambia under the Fifth Review of the Extended Credit Facility. The IMF acknowledged Zambia’s continued commitment to macroeconomic stability and structural reforms. The economy is projected to grow by 5.8% in 2025, driven by recovery in agriculture, increased mining activity, and infrastructure development. However, achieving inclusive and sustained growth will depend on progress in public sector reform, debt sustainability, and domestic revenue mobilization.

Energy Sector

Zambia Launches Transformative Electricity Subsidy to Boost Energy Access

The Zambian government has introduced a landmark electricity subsidy under the National Energy Advancement Transformation (NEAT) Programme, launched by Energy Minister Hon. Makozo Chikote, MP in Itezhi Tezhi District on 29th May 2025. This initiative marks a critical step in addressing Zambia’s energy challenges, coming just as the country recovers from last year’s severe power shortages. For Zambians, particularly in rural communities, this subsidy represents a life-changing opportunity.

By significantly reducing connection and consumption costs, the program enables households to power their homes and supports small businesses in operating more productively. The initiative directly tackles energy poverty – a major barrier to development – by allowing children to study after dark, clinics to refrigerate medicines, and entrepreneurs to grow their enterprises. These improvements align perfectly with Zambia’s commitment to Sustainable Development Goal 7, Vision 2030, and the Eighth National Development Plan, all of which prioritize affordable, reliable energy access as a foundation for national progress. While recent improvements in power supply have eased load-shedding, the NEAT subsidy ensures these benefits reach underserved communities. Its success depends on strong implementation, but the initiative already represents a bold move toward universal electrification, a foundation for Zambia’s sustainable development. By bridging the urban-rural energy gap, the government is powering not just homes, but the nation’s future.

Chisamba Solar Project

The Chisamba Solar Power Plant, a 100 MW project led by KNBEPC and financed by Stanbic Bank, was 91% complete as of late May. Once operational, it will significantly contribute to addressing Zambia’s 750 MW electricity deficit. This investment reflects a growing shift toward renewable energy as the country grapples with load-shedding and climate-driven hydroelectric variability. The plant will also improve energy security and reduce reliance on costly emergency imports.

New Solar and Storage Developments

In addition to Chisamba, Zambia is advancing several solar projects, including the Choma Solar Plant, which will combine 60 MW of solar capacity with a 20 MWh battery energy storage system (BESS). These developments represent a deliberate move to modernize the power grid and introduce flexibility through storage. They are expected to improve power reliability, stabilize supply during peak hours, and attract private-sector participation in the energy space.

Regional Power Trade and Infrastructure

In May, Zambia approved a $270 million transmission line project to link its grid with the Democratic Republic of Congo. This project supports broader regional integration and is part of the Southern African Power Pool (SAPP) strategy to promote energy trade. Alongside this, the Zambia-Tanzania-Kenya (ZTK) interconnector remains under development and is expected to enhance regional energy security by 2027. These cross-border infrastructure projects also position Zambia as a key player in regional power markets.

Open Access and Private Sector Role

Regulatory reforms under Zambia’s 2024 Open Access Regulations continued to take effect in May, enabling independent power producers (IPPs) and large consumers to trade power directly across the grid. Companies like CEC, Africa GreenCo, and Solarcentury are already participating. This policy shift marks a significant liberalization of the electricity sector and is expected to increase competition, improve efficiency, and drive down long-term energy costs.

Conclusion

Zambia’s economy in May 2025 is a tale of two realities. On one hand, declining inflation, a stronger Kwacha, and a thriving stock market offer hope for recovery. On the other, the soaring cost of basic needs, tepid demand for government debt, and lingering energy vulnerabilities underscore the fragility of this progress. The government’s bold energy subsidies and renewable projects signal a commitment to long-term growth, but sustained reform, especially in fiscal discipline and structural diversification, will be critical to locking in these gains. For now, investors are betting on equities, consumers are grasping at fleeting relief, and the nation stands at a pivotal juncture. The months ahead will test whether Zambia can turn this fragile momentum into enduring stability- or if global headwinds and domestic gaps will keep progress just out of reach. One thing is clear: vigilance and adaptability will be the currency of success.