Introduction

January 2024 revealed a multifaceted economic landscape in Zambia. The transition from a trade deficit to a surplus, modest inflation upticks, fuel price adjustments, income disparities, and strategic financial initiatives unfolded key facets. Notable developments include the introduction of the Electronic Export Proceeds Tracking Framework (EPTF) and the Bank of Zambia’s visionary 2024-2027 plan. Zambia’s adaptive response in bond issuance and market adjustments further showcased resilience amid dynamic global forces. The month also witnessed significant milestones in corporate leadership transitions and the listing of Zambia’s first Green Bond.

Trade Dynamics: Zambia’s Transition from November Deficit to December Surplus

In December 2023, Zambia experienced a notable shift in its trade balance, registering a trade surplus of K0.7 billion compared to a deficit of K0.6 billion in November of the same year. The preceding month, November 2023, saw trade figures with exports and imports amounting to K18.4 billion and K19.0 billion, respectively, leading to a trade deficit of K0.6 billion. However, in a positive turn of events, December witnessed an upswing with a trade surplus of K0.7 billion, fueled by increased exports totaling K21.1 billion and imports reaching K20.4 billion. This marked transition showcases the dynamism of Zambia’s trade landscape within a short time frame.

Inflation Trends: January 2024 Overview

The annual inflation rate for January 2024 inched up to 13.2%, a modest increase from December 2023’s 13.1%. This uptick was primarily driven by developments in selected non-food items. A year-on-year analysis reveals a 13.2% growth in the prices of goods and services between January 2023 and January 2024, contrasting with the 9.4% inflation recorded in January 2023. The change in inflation from December 2023 to January 2024 is comparatively subtle, distinguishing itself from sharper fluctuations observed in previous months, notably the significant spike from August 2023 to September 2023.

In terms of specifics, annual food inflation for January 2024 experienced a slight decrease to 13.7%, down from 14.2% in December 2023. This shift can be attributed to a reduction in prices for selected meats and vegetables, according to the Zambia Statistics Agency.

Conversely, annual non-food inflation for January 2024 increased to 12.4%, up from 11.6% in December 2023. This rise can be traced to increased prices in selected categories such as motor cars, spare parts, accessories, passenger transport by air, charcoal, and blankets.

The upward trajectory in the annual inflation rate was influenced by various groups, including alcoholic beverages and tobacco, furnishing, household equipment and maintenance, transport, communication, recreation and culture, education, restaurants and hotels, as well as miscellaneous goods and services. In contrast, certain groups contributed to a slowdown in inflation, namely food and non-alcoholic beverages, clothing and footwear, and housing, water, electricity, gas, and other fuels. Notably, the health Consumer Price Index (CPI) group remained stable during this period.

ERB Announces Fuel Price Adjustments Amidst Kwacha Depreciation

The Energy Regulation Board (ERB) of Zambia has declared adjustments in the pump prices of key petroleum products, effective from midnight on January 31, 2024. Reynolds Bowa, the Chairperson of the ERB, attributes this modification directly to the depreciation of the Kwacha. While kerosene prices remain unaffected, the state of the Kwacha has influenced wholesale and pump prices for other petroleum products.

| PETROL | DIESEL LOW SULPHUR GASOIL | JET A-1 FUEL | KEROSENE | |

| OLD | K29.98 | K29.96 | K29.29 | K20.44 |

| REVISED | K34.19 | K32.15 | K32.69 | K20.44 |

These adjustments carry both direct and indirect consequences for individuals and the broader economy. The direct impact is felt by businesses and individuals who heavily rely on petroleum products. The transportation sector, in particular, experiences a direct impact on its input source, resulting in increased costs for transportation, production, and other associated expenses. These changes extend to every stratum of Zambian society, given that energy serves as a fundamental input across various sectors and commodities. Consequently, both the Kwacha depreciation and the rise in fuel prices contribute to inflationary pressures on the cost of living and operational expenses for businesses.

Disparities in Income and Cost of Living

According to the Jesuit Centre for Theological Reflection, the calculated national average monthly earnings are reported to be K5,342. However, there are notable discrepancies in income across gender, rural, and urban areas, with incomes falling below or exceeding the average in these respective categories. This average is significantly lower than the estimated cost of living, which the Center places at K9,157.41 for a family of five in Lusaka as of December 2023. Despite being a measure tailored for a family of five, it underscores the grim reality that a considerable portion of the Zambian population is grappling with poverty, earning incomes below the national average, particularly those engaged in the informal sector.

The gap between the average estimated earnings and the cost of living illuminates the challenges many families encounter in meeting their fundamental needs. This discrepancy raises concerns about the adequacy of earnings to cover the basic cost of living, emphasizing a pressing issue that requires attention.

Launch of Electronic Export Proceeds Tracking Framework

The commencement of the Electronic Export Proceeds Tracking Framework (EPTF) on January 1, 2024, marks a significant milestone in export oversight. This framework is designed to meticulously monitor all export transactions, ensuring that the corresponding export proceeds are deposited into Zambian accounts. Businesses and individuals will receive these export receipts through Customer Foreign Currency (CFC) accounts, aligned with the existing banking system. These accounts are mandated to be maintained with a financial institution domiciled in Zambia.

To facilitate seamless tracking, the Bank of Zambia will monitor export receipts utilizing Zambian Revenue Authority (ZRA) tax identification numbers, a requirement for all exporters. Consequently, the framework necessitates exporters to obtain a tax identification number from ZRA, thereby establishing a streamlined and accountable process for export proceeds.

Bank of Zambia’s Vision 2024-2027: Elevating Digital Financial Services and Fortifying Cybersecurity in the Financial Sector

The Bank of Zambia has undertaken a significant expansion of digital financial services, concurrently augmenting the efficiency of its payment system. Notably, the institution has recently unveiled its strategic plan and payment vision for the period 2024-2027. Among its primary objectives, the plan aims to proactively tackle cybersecurity risks within the financial sector. This strategic initiative reflects the bank’s commitment to modernizing financial services while prioritizing the security and resilience of the financial sector.

Bonds

The outcomes of the GRZ Bond Tender conducted on January 19, 2024, reflect the initiation of a modified issuance method for the Government of the Republic of Zambia Bonds. This alteration, which took effect in January 2024, mandated the issuance of bonds at their par value. Additionally, it stipulated that the coupon rate for each bond would correspond to the respective highest accepted yield rate. Consequently, all bonds were issued at par value, and their respective coupon rates were determined based on the highest accepted yield rates.

| TENOR | PRICE | CUT OFF COUPON RATE |

| 2 years | K100.00 | 17.00% |

| 3 years | K100.00 | 20.00% |

| 5 years | K100.00 | 22.00% |

| 7 years | K100.00 | 23.00% |

| 10 years | K100.00 | 24.97% |

| 15 years | K100.00 | 26.50% |

The Bank of Zambia has made an adjustment to the auction sizes for bonds, reducing them to K2.0 billion from the previous K2.6 billion in 2023. Notably, there was a surplus of demand for bonds in January, particularly for the 3-year, 5-year, 10-year, and 15-year bonds, with the highest demand observed for the 10-year bond. In contrast, the 2-year and 7-year bonds experienced undersubscription. Overall, the total amount bid by investors surpassed the amount offered by the Bank of Zambia. The upcoming auction is scheduled for February 16, 2024.

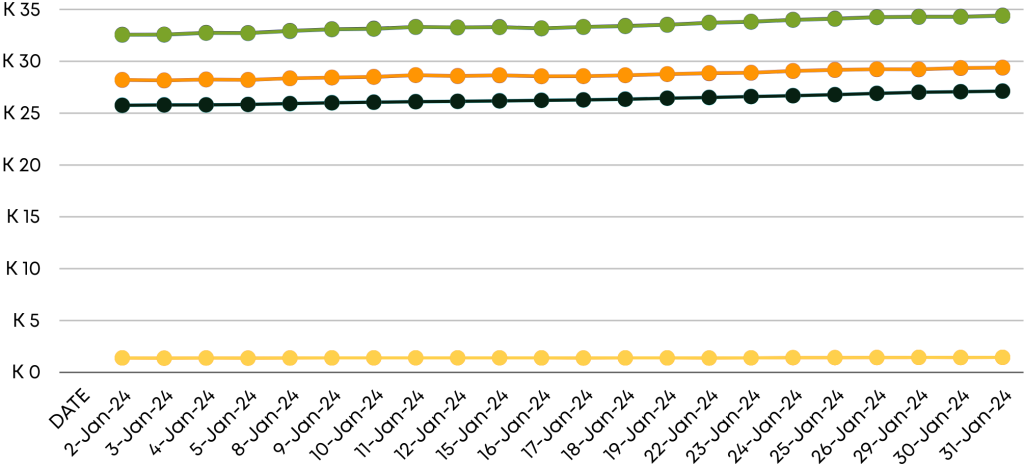

Exchange Rates

The initial exchange rates in January 2024 were notably high, with opening rates of K25.75 for the USD, K32.56 for the GBP, K28.21 for the Euro, and K1.39 for the ZAR. However, these rates experienced a continuous upward trend throughout the month, showing inconsistency. By the end of January, midrates were recorded at K27.12 for the USD, K34.40 for the GBP, K29.39 for the Euro, and K1.45 for the ZAR. Analyzing the changes from the beginning to the end of the month reveals a 5.3 percent increase for the USD, a 5.6 percent increase for the GBP, a 4.2 percent increase for the Euro, and a 4.2 percent increase for the ZAR, indicating a depreciation of the Kwacha.

A weakening currency can contribute to inflationary pressures. As the Kwacha depreciates, the costs of imported goods and commodities may increase, potentially resulting in higher inflation. Conversely, export-oriented industries may benefit as their products become more competitively priced in international markets. Investors may express concern about inflation’s impact on consumers’ purchasing power and the overall economic stability. Additionally, the depreciation may affect foreign investors, diminishing the value of their returns upon repatriating funds. Nonetheless, it might enhance the attractiveness of local assets to foreign investors if they anticipate a reversal in the depreciation trend. Lastly, the depreciating Kwacha raises the cost of servicing government debt denominated in foreign currencies. Prolonged depreciation could give rise to worries about economic stability and undermine investor confidence.

Stock Market

In accordance with Section 3.59 of the Listing Requirements, Zanaco Plc’s Board of Directors announces important developments as of the quarter ending 31 December 2023. Mr. Patrick Wanjelani, the Board Chairperson, officially retired from the Zanaco Board on 22nd November 2023 upon the completion of his tenure. The Board wishes to express gratitude for Mr. Wanjelani’s contributions. Concurrently, Mrs. Regina Mulenga, the Vice Board Chairperson, has been appointed as the interim Chairperson. The due process for appointing a substantive Chairperson is underway.

Zambia Sugar Plc has reported a total sales volume of 390,170 tonnes for the fiscal year 2023, reflecting a marginal increase from the 382,337 tonnes recorded in 2022. Additionally, the company has declared a final dividend of 349 ngwee per share.

On January 13, 2024, CEC Renewables Ltd., a subsidiary of Copperbelt Energy Corporation (CEC), successfully listed Zambia’s inaugural Green Bond on the Lusaka Securities Exchange (LuSE). This landmark achievement signifies a substantial step forward in advancing renewable energy development within the country. The listing of Zambia’s first Green Bond is expected to play a crucial role in fostering sustainability and environmental consciousness in the energy sector.

These updates provide shareholders and the public with important information about leadership transitions, corporate performance, and noteworthy accomplishments within Zambia’s financial and energy sectors.

In the realm of share prices, Zambia Sugar observed a notable gain, experiencing a change increase of approximately K2.50. Cec, Pamodzi, Zamefa, Puma, Reiz, Scz, Zsug, Zanaco, and Bata all witnessed increases in their share prices, with CEC displaying minor fluctuations. Airtel and Chilanga maintained their share prices but saw reductions within the month. Conversely, Aeci and Zambeef encountered a decline in their stock prices. The respective prices for these shares on January 1st and January 31st are as follows.

| COMPANY | PRICES (1st JAN 2024) | PRICES (31st JAN 2024) | PRICE CHANGE | % CHANGE | MID MONTH CHANGES |

| AECI | K 41.98 | K 41.80 | -K 0.18 | -0.43% | |

| AIRTEL | K 43.50 | K 43.50 | K – | 0.00% | K 43.30 |

| CEC | K 7.09 | K 7.13 | K 0.04 | 0.56% | |

| CHILANGA | K 13.80 | K 13.80 | K – | 0.00% | K 13.70 |

| PAMODZI | K 0.71 | K 0.80 | K 0.09 | 12.68% | |

| ZAMEFA | K 4.90 | K 5.00 | K 0.10 | 2.04% | K 4.97 |

| PUMA | K 2.50 | K 2.55 | K 0.05 | 2.00% | |

| REIZ | K 1.30 | K 1.31 | K 0.01 | 0.77% | |

| SCZ | K 1.50 | K 1.65 | K 0.15 | 10.00% | |

| ZAMBEEF | K 2.53 | K 2.51 | -K 0.02 | -0.79% | |

| ZSUG | K 35.00 | K 37.50 | K 2.50 | 7.14% | |

| ZANACO | K 3.80 | K 4.05 | K 0.25 | 6.58% | |

| BATA | K 3.00 | K 3.16 | K 0.16 | 5.33% |

Conclusion

Zambia’s economic trajectory in January 2024 reflects resilience, challenges and adaptability. The positive trade balance shift, guided by increased exports and imports, signals the nation’s ability to navigate trade dynamics. However, challenges persist with inflationary pressures, fuel price adjustments, depreciation of the Kwacha, and income disparities, warranting sustained attention. The commitment to modernization, sustainability, and strategic financial adjustments positions Zambia for continued resilience.