Introduction

This report provides a comprehensive analysis of key economic indicators for July 2024, focusing on inflation rates, exchange rates, the Lusaka Securities Exchange (LuSE), the Energy Regulation Board (ERB), and Government Bond auctions. Understanding these elements is crucial for assessing the economic environment and investment climate for the period.

Inflation is a key indicator of economic health, reflecting changes in the cost of living and the purchasing power of the currency. This report examines the inflation rate for July 2024, analyzing its trends, contributing factors, and implications for consumers and businesses. We will also review the performance of the domestic currency against major foreign currencies, evaluate local equities and market/investor sentiment, and assess the outcomes of recent bond auctions.

By analyzing these indicators, the report aims to provide a comprehensive perspective on the economic landscape during the period under review. This detailed analysis will enable stakeholders to make informed decisions based on current economic conditions and market trends. By understanding these factors, stakeholders can better navigate the economic environment, optimize investment strategies, and anticipate potential challenges and opportunities in the market.

Currency Highs and Lows

In July, the Zambian kwacha experienced significant volatility in its performance. Early in the month, the currency appreciated as a result of favorable economic conditions and a boost in foreign investment, which strengthened investor confidence and demand for the kwacha. However, as the month progressed, the kwacha came under pressure and began to depreciate. This downward trend was driven by a combination of external economic factors, such as geopolitical uncertainties, as well as persistent internal challenges, including a continued rise in inflation rates. The combination of these pressures created a complex environment for the kwacha, leading to notable fluctuations in its value throughout July.

CURRENCY | BUYING (3 JULY) | SELLING (3 JULY) | BUYING (31 JULY) | SELLING (31 JULY) |

| USD – Dollar | 24.2051 | 24.2551 | 26.1438 | 26.1938 |

| GBP – Pound | 30.7865 | 30.8671 | 33.5817 | 33.6485 |

| EUR – Euro | 26.0761 | 26.1349 | 28.3372 | 28.3941 |

| ZAR – Rand | 1.3133 | 1.3163 | 1.4353 | 1.4383 |

For investors who hold assets denominated in foreign currencies, such as USD, a depreciation of the local currency can significantly enhance their returns when these returns are converted back into the domestic currency. This occurs because the value of their foreign assets appreciates relative to the weakened local currency. Investors must therefore consider not only the performance of their foreign investments but also the impact of exchange rate fluctuations on their returns upon conversion.

Cost of Living Soars in 2024

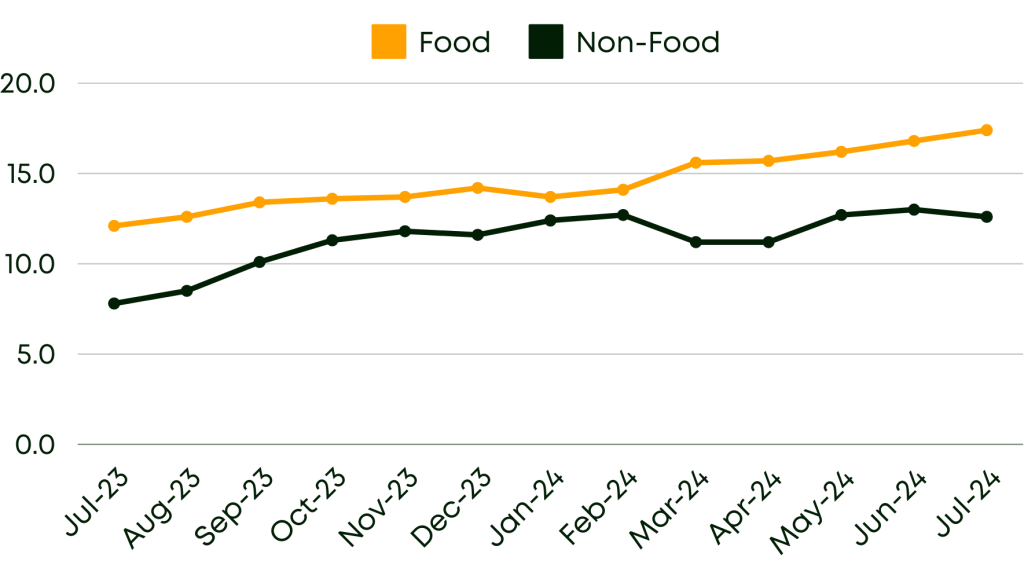

Annual inflation for July 2024 increased to 15.4% from 15.2% recorded in June 2024. Indicating that on average, prices of goods and services increased by 15.4% between July 2023 and July 2024. This development was mainly attributed to price movements of food items. Annual food inflation increased to 17.4% in July, a 3.6% rise from its previous record in June. Conversely, non-food inflation reduced to 12.6% from the 13% recorded in the previous month due to subdued price pressure for major household appliances such as refrigerators, washing machines, and microwaves. Below is the food and non-food inflation trend between July 2023 and July 2024.

Inflation in Zambia, as in many other countries, is influenced by various factors that affect prices in both the short and long term. Understanding these factors is essential for comprehending how inflation evolves and the mechanisms driving price changes. In Zambia, various factors contribute to inflation in both the short and long term. When the Zambian Kwacha depreciates against major currencies like the US Dollar, the cost of imported goods and services increases. This results in higher overall prices in the domestic market, contributing to short-term inflation. Rising global oil prices or disruptions in local fuel supply can increase transportation and production costs, these higher costs are often passed on to consumers.

Inflationary pressures from trading partners, especially South Africa and other major suppliers, can spill over into Zambia, leading to higher prices for imported goods and raw materials. Supply chain disruptions, whether caused by natural disasters (e.g., Zambia’s current drought situation), political instability, or other factors, can lead to shortages of goods. These shortages result in short-term price increases. During times of economic growth or increased government spending, the demand for goods and services can exceed supply, leading to higher prices. Maize being the staple food in Zambia, any increase in maize prices due to supply constraints or poor harvests can have a substantial impact on overall inflation. When maize prices rise, the cost of maize-based products, such as mealie meal, also increases. This leads to higher food prices, which constitute a significant portion of the average household’s expenses.

Over time, excessive growth in the money supply compared to economic output can cause inflation. When the central bank prints more money without a corresponding increase in goods and services, it diminishes the currency’s purchasing power. Persistent budget deficits financed through borrowing or money creation can also result in inflation. Sustained high government spending, particularly when not matched by equivalent revenue, can increase aggregate demand and prices.

Additionally, structural changes in the economy or slow productivity growth can contribute to inflation. For example, if productivity increases slowly, the cost of producing goods rises, leading to higher prices. Extended depreciation of the Kwacha can result in consistently higher import prices, contributing to long-term inflationary pressure, and if businesses and consumers expect prices to rise in the future, they might react by hiking prices or demanding higher wages. This can create a self-fulfilling cycle of continuous inflation.

A Closer Look at the Drop-in Government Bond Investor Participation

The Government Bond auction held on Friday, July 19, 2024, revealed a significant decline in investor interest. The results indicate a marked decrease in demand compared to previous auctions this year, excluding the May auction which reflected a similar outcome. Detailed results are outlined below

| Tenor | Amount Offered | Amount Bid | Amount Allocated | Coupon Rate (%) |

| 2 years | K280.00 Mn | K114.80 Mn | K112.80 Mn | 19.000 |

| 3 years | K320.00 Mn | K83.46 Mn | K80.93 Mn | 20.5000 |

| 5 years | K330.00 Mn | K195.52 Mn | K193.52 Mn | 22.5000 |

| 7 years | K240.00 Mn | K113.29 Mn | K113.29 Mn | 24.0000 |

| 10 years | K240.00 Mn | K97.30 Mn | K96.50 Mn | 25.7500 |

| 15 years | K190.00 Mn | K134.83 Mn | K134.33 Mn | 27.2500 |

| Total | K1,600.00 Mn | K739.20 Mn | K731.37 Mn |

The results showed an under-subscription across all maturity periods, this can be primarily attributed to the local currency’s depreciation against the US dollar. The exchange rate shifted from ZMW25.8709 per USD1 at the beginning of the auction week to ZMW26.2956 during bid submission, before returning to ZMW25.7690 per USD1 on the auction day. Investors may see a higher exchange rate as an increased risk. If the local currency is expected to depreciate further, investors might consider holding bonds risky due to the potential erosion of returns upon maturity, especially in our current “dollarized” economy.

Additionally, it can be attributed to the country’s double-digit inflation rate which has been steadily increasing since the start of the year. Nevertheless, despite the decreased demand, coupon rates for the 2-year and 7-year tenors rose by 1.5% and 0.5% respectively. This adjustment could stimulate investor interest in the upcoming bond auction scheduled for Friday 30 August, 2024.

Equity Insights

In July, the Lusaka Securities Exchange (LuSE) demonstrated significant market activity, reflecting the dynamic nature of the Zambian equity market. The LuSE All Share Index (LASI) experienced notable fluctuations over the month, mirroring shifts in market sentiment and trading volumes. At the start of July, the LASI closed at 13,873.85 points with a market capitalization of K114.4 billion. By the end of the month, the index had risen to 14,462.17 points, accompanied by an increased market cap of K118.5 billion. This rise in the index underscores a positive shift in market conditions and investor confidence.

Throughout the month, while several stocks achieved notable gains, others experienced declines. This mixed performance highlights the diverse nature of market reactions to various economic factors and corporate news. Additionally, trading volumes saw a marked increase compared to previous months, indicating heightened investor activity and renewed interest in the market. This surge in trading activity suggests an active investment environment and a strong engagement from market participants.

| COMPANY | PRICE (3 JULY) | PRICE (31 JULY) | PRICE CHANGE | % PERIOD CHANGE |

| AECI | 40.00 | 40.00 | 0.00 | 0.00 |

| ATEL | 43.50 | 43.50 | 0.00 | 0.00 |

| BATA | 4.89 | 5.00 | 0.11 | 2.25 |

| BATZ | 2.53 | 3.00 | 0.47 | 18.58 |

| CECZ | 10.00 | 11.39 | 1.39 | 13.90 |

| CHIL | 16.50 | 17.00 | 0.50 | 3.03 |

| MFIN/MAFS | 1.86 | 1.83 | -0.03 | -1.61 |

| NATB | 4.10 | 4.10 | 0.00 | 0.00 |

| PMDZ | 4.62 | 4.62 | 0.00 | 0.00 |

| ZMRE | 2.80 | 2.80 | 0.00 | 0.00 |

| PUMA | 3.99 | 5.15 | 1.16 | 29.07 |

| REIZ | 2.00 | 1.98 | -0.02 | -1.00 |

| SCBL | 3.50 | 3.47 | -0.03 | -0.86 |

| SHOP | 80.00 | 80.00 | 0.00 | 0.00 |

| ZMBF | 2.19 | 2.18 | -0.01 | -0.46 |

| ZMBR | 7.00 | 7.00 | 0.00 | 0.00 |

| ZAMEFA | 5.01 | 5.01 | 0.00 | 0.00 |

| ZNCO | 6.28 | 6.10 | -0.18 | -2.87 |

| ZCCM | 54.00 | 64.00 | 10.00 | 18.52 |

| ZAFFICO | 2.53 | 2.53 | 0.00 | 0.00 |

| ZSUG | 35.00 | 35.00 | 0.00 | 0.00 |

CECZ Group Chief Executive Officer Owen Silavwe, at the Energy Indaba held earlier in the month, announced that imported power will begin arriving in Zambia in August 2024 to address a significant shortfall in the mining industry, estimated between 20% and 30%. This move follows ZESCO’s decision to recall 20% of the energy previously supplied to the mines. The company indicated that it had signed agreements with a mining house with which it has terms of business to provide the deficit through imported power.

PUMA Energy announced a profit after tax of approximately K255 million for the year ending December 31, 2023. This result was largely due to a 12% increase in volumes and higher selling prices, which were influenced by rising oil prices. Furthermore, the company’s share price experienced a decent increase in July. It began at K3.99 and surged to K5.15 by the end of the period, representing a notable appreciation. This 29% rise in share value underscores a significant shift in market perception and investor confidence. The increase in PUMA’s stock price may be attributed to positive company performance and successful strategic initiatives.

On Monday, July 29, 2024, ZCCM-IH presented a K146 million dividend cheque to its majority shareholder, the Industrial Development Corporation (IDC), for the December 31, 2023 financial year. This dividend payment signifies the 9th consecutive year that ZCCM has rewarded its majority shareholder with a dividend. In the previous year, a substantial dividend payout of K436 million was made, covering the financial years 2021 and 2022. Over the past nine years, ZCCM has distributed approximately K990 million in dividends to the IDC.

This consistent financial return underscores ZCCM’s commitment to delivering value to its shareholders and highlights the company’s strong performance and sustainable growth. Additionally, the company demonstrated a notable appreciation in its share price for the month. The share price began at K54 and rose to K64 by the month’s end, marking a significant increase. This rise reflects a positive shift in investor sentiment and market confidence in the company’s performance and prospects. The 18.5% gain over the period highlights strong market interest and potentially robust financial health and strategic developments within the company.

In July, the LuSE saw significant movements among its listed stocks, with notable performances from both gainers and losers. The top performers for the month were CECZ), PUMA Energy, and ZCCM. These stocks experienced substantial increases in their share prices, reflecting strong investor interest and positive market sentiment surrounding their financial health or operational developments. Conversely, the biggest decliners were ZNCO, MFIN, and REIZ. These stocks faced declines in their share prices, indicating potential challenges or negative investor perceptions impacting their market performance. The rise in share prices for leading stocks, combined with the increased trading volumes observed throughout the month, highlights a dynamic and active market environment. This activity suggests heightened investor engagement and a responsive market, influenced by various economic and corporate factors.

Delisting and Resolution of Investrust Bank Plc

On July 8, 2024, the Bank of Zambia (BoZ) informed depositors, directors, shareholders, creditors, and other interested parties that Investrust Bank Plc had been placed under compulsory liquidation under Section 127 of the Banking and Financial Services Act, 2017. On July 15 the LuSE formally terminated the listing of Investrust Bank Plc in line with Section 1.11 of the LuSE listings requirements. Under Section 73 of the Banking and Financial Services Act 2020, the Bank of Zambia has arranged a Purchase and Assumption (P&A) Transaction with Zambia Industrial Commercial Bank Limited (ZICB). This transaction, supported by government funding to ensure financial system stability, involved the transfer of all deposit liabilities along with corresponding assets, as well as the acquisition of additional assets selected by ZICB. Effective July 15, all customers with outstanding deposit balances at Investrust Bank had their deposits transferred to ZICB, where they will continue to receive full banking services. Additionally, ZICB will assume control of certain Investrust Bank locations.

Fuel Price Reversal

In July, international petroleum prices surged above the monthly average recorded in June. This increase was primarily driven by two key factors. Firstly, the summer driving season in the Northern Hemisphere led to an increased demand for fuel, as travel and consumption typically peak during this period. Secondly, geopolitical tensions in the Middle East contributed to global supply uncertainties. Regional conflicts and political instability in this key oil-producing area raised concerns about potential supply disruptions, further driving up prices. Together, these dynamics created upward pressure on petroleum costs in the global market, increasing local fuel prices.

PRODUCT | PUMP PRICES K/LITRE | ||

| JULY PRICE | AUGUST PRICE | % CHANGE | |

| Petrol | 31.58 | 33.47 | 6.02 |

| Diesel | 29.34 | 30.05 | 2.39 |

| Kerosene | 26.36 | 27.52 | 4.40 |

| Jet A-1 | 29.20 | 30.53 | 4.55 |

The Energy Regulation Board (ERB) is working on a new pricing model designed to benefit both oil marketing companies (OMCs) and consumers. ERB’s Director of Economic Regulations, Alfred Mwila, noted that the import parity pricing model is currently under review by stakeholders. The Government is focused on finding a price structure that balances consumer affordability with the business interests of the OMCs.

Conclusion

In July, Zambia’s economy exhibited mixed signals. While there were positive indicators such as initial currency appreciation and increased foreign investment, the latter part of the month saw challenges including currency depreciation and economic uncertainties. These fluctuations underscore the need for continued economic reforms and strategic management to stabilize growth and enhance resilience against external and internal pressures.

The volatility in the exchange rate highlighted the ongoing complexities in Zambia’s economic landscape and the impact of global market dynamics on local currency performance. The rising inflation rate can significantly affect local investments. For Government Bonds, increased inflation typically erodes the real value of fixed-interest payments, making them less attractive to investors. Unit trusts and mutual funds may struggle as higher inflation can lead to increased uncertainty and potentially lower returns if they are heavily invested in inflation-sensitive sectors. Dollar savings accounts might become more appealing due to their potential to offer better returns compared to local currency accounts, as they can hedge against local inflation. Overall, investors may seek safer or higher-yielding options to protect capital, influencing allocation across different investment types.

The effectiveness of regulatory systems in Zambia, such as BoZ and the LuSE, is crucial for maintaining financial stability and market integrity. BoZ plays a key role in overseeing banking operations and ensuring financial system stability, while LuSE regulates capital market activities to promote transparency and investor confidence. Their efforts are essential for fostering a secure and reliable financial environment in Zambia.