Zambia’s economy stands at a critical inflection point as we analyse April 2025’s performance. The macroeconomic landscape presents a paradox – while inflationary pressures show tentative signs of moderation from their 16.8% peak, structural vulnerabilities in currency stability and household purchasing power continue to test the nation’s economic resilience. This report dissects these complex dynamics through three critical lenses:

1. The persistent inflation-food security-exchange rate trilemma that continues to challenge monetary policymakers

2. Diverging capital market performance between Treasury instruments and equities

3. Emerging opportunities in energy sector reforms and regional trade integration

MACROECONOMIC FACTORS

The data shows both warning signals and green shoots. The kwacha’s 4.6% year-on-year depreciation and elevated Basic Needs Basket costs paint a sobering picture of household economic stress. Yet simultaneously, we observe surprising strength in long-dated government bond demand and promising developments in regional energy partnerships. This dichotomy defines Zambia’s current economic reality – an economy in transition, where every challenge contains the seeds of opportunity, and every strength faces countervailing pressures.

Inflation

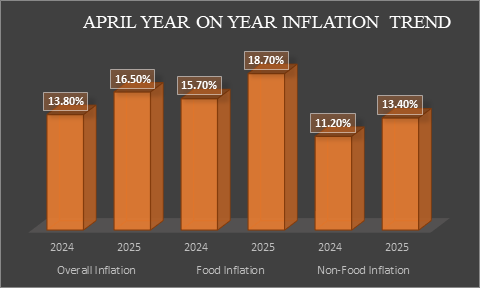

As of April 2025, Zambia’s annual inflation rate stood at 16.5%, reflecting a significant rise from 13.8% in April 2024. This increase was largely driven by persistent food price pressures and a depreciating kwacha. In early 2024, a severe drought, the worst in two decades, led to substantial food shortages and a national emergency declaration, pushing food inflation to 15.7% by April 2024. Despite improved rainfall in early 2025 aiding agricultural recovery, food inflation remained elevated at 18.7% in April 2025. Non-food inflation also rose to 13.4%, influenced by higher costs in transportation and accommodation services. Looking ahead, the Bank of Zambia projects average inflation to moderate to 14.6% by the end of 2025 and further to 10.6% in 2026, though still above the target range of 6–8%. The anticipated decline is attributed to improved food supply and electricity generation due to favourable rainfall. However, risks such as exchange rate volatility and global economic uncertainties may continue to exert upward pressure on prices. Therefore, while monetary policy measures have begun to stabilize inflation, sustained efforts are required to achieve the desired inflation targets.

Exchange-Rate trend

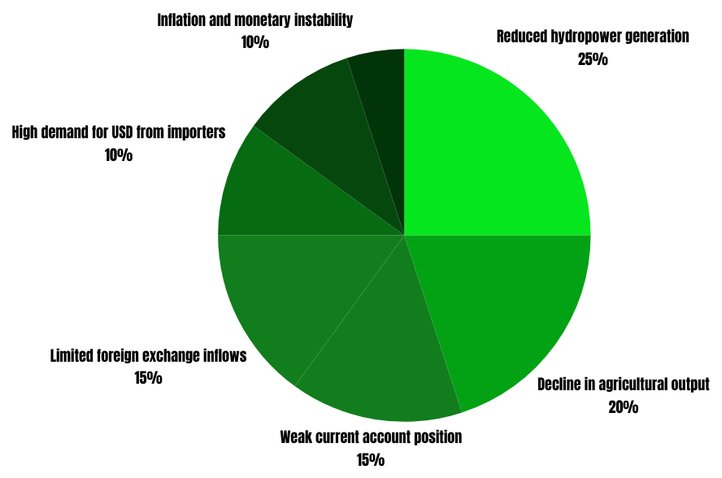

In the first quarter of 2025, the Zambian kwacha faced sustained pressure, marked by notable depreciation against the U.S. dollar due to a combination of economic shocks and structural weaknesses. At the start of the year, the kwacha hovered around K26.50 per USD but weakened significantly to a low of K28.94 on March 25. By April 30, 2025, the currency had appreciated slightly to K27.93, bringing some short-lived relief. However, compared to April 30, 2024, when the kwacha was trading at K26.71 per USD, this still represents a year-on-year depreciation of approximately 4.6%. The depreciation in 2025 was driven largely reduced hydropower generation and agricultural output, worsening Zambia’s current account position and lowering foreign exchange inflows. Although the Bank of Zambia tightened monetary policy by raising the benchmark interest rate to 14.5% and implemented liquidity-absorbing measures, these efforts only partially slowed the depreciation trend.

In comparison, April 2024 saw an even sharper exchange rate shift. The kwacha depreciated from K24.96 per USD on April 1 to K26.71 by the end of the month, a 7% drop in just four weeks. This abrupt weakening was an early signal of the worsening drought and the inflationary pressures that would escalate over the remainder of the year. While the magnitude of depreciation was greater in April 2024 over a shorter period, the depreciation in 2025 has been more sustained and reflective of ongoing structural challenges, including elevated inflation, limited reserves, and external debt pressures. Even with the slight appreciation observed in April 2025, the kwacha remains under pressure from high demand for U.S. dollars, particularly from importers. Looking ahead, exchange rate stability will likely depend heavily on improved export performance, continued fiscal consolidation, and increased external financing support.

Basic Needs and Nutrition Basket

In April 2025, the Basic Needs and Nutrition Basket (BNNB) for a family of five in Lusaka was recorded at K11,417.99, marking a year-on-year increase of approximately 7.7% from K10,603 in April 2024. This rise in the cost of living reflects the persistent economic strain on Zambian households, driven by a mix of inflationary pressures, supply chain disruptions, and the lingering effects of drought on food production and energy supply. Although the April 2025 basket showed a slight monthly decrease of K128.79 from March,(largely due to improved availability and lower prices of some fruits and charcoal), this did little to offset the broader upward trajectory observed over the past year.

By contrast, April 2024 had already seen a worrying surge in basic costs, with the BNNB increasing by nearly 3% from the previous month. That spike was largely driven by rising prices of key staples like roller mealie meal and fruit, signalling the early impact of climatic and economic stressors that would deepen in 2025. What is particularly concerning is that in both years, the cost of the basket far exceeds the average formal sector income, which in April 2025 stood at K7,731, and more than doubles the national average income of K5,369. This widening gap between household incomes and essential living costs illustrates a growing affordability crisis for many Zambian families.

In 2025, Zambia’s microeconomic environment has been shaped by a confluence of inflationary pressure, currency instability, rising living costs, and tightening monetary policy, all of which are deeply influencing both investor behavior and consumer habits. Inflation, though slightly easing to 16.5% in April, has remained persistently high throughout the year, reducing the real purchasing power of consumers and pushing many households to reprioritize spending toward essentials like food, fuel, and transport. This has led to weaker demand in non-essential sectors such as retail and services, which in turn affects business profitability and hiring decisions. At the same time, the kwacha has depreciated year-on-year, especially against the U.S. dollar, due in part to reduced export earnings, drought-affected agricultural output, and pressure on foreign reserves. This depreciation has made imports more expensive, driving up the cost of goods and undermining price stability.

For investors, continued fiscal challenges, trade deficits, and energy insecurity are keeping risk perceptions high, leading many investors to remain cautious or delay new commitments. For domestic investors, high interest rates have made borrowing more expensive, reducing appetite for expansion and credit-funded projects.

For those with limited financial means, the elevated cost of living has forced a shift in priorities away from saving or investing and toward immediate consumption. As food, fuel, and basic needs become more expensive, lower-income individuals are less likely to participate in capital market activities such as buying government bonds, stocks, or unit trusts. Their financial choices may be increasingly defensive, focused on liquidity and survival rather than growth or returns. Moreover, rising interest rates, while meant to curb inflation, have made credit more expensive, further restricting access to capital that might have otherwise been used for small business ventures or micro-investments.

Conversely, individuals and institutions with greater financial resources are navigating the landscape differently. While inflation and currency volatility introduce uncertainty, they also open up opportunities (particularly in fixed-income securities like Treasury bills and government bonds), which may offer attractive yields and more liquidity compared to other investment options on the market. Wealthier investors are better positioned to absorb short-term risks and can allocate capital strategically, sometimes even taking advantage of market dips to acquire undervalued assets.

Taken together, these microeconomic factors paint a picture of a constrained economy where consumers are tightening belts and investors are watching policy and market signals closely, seeking assurance that the macroeconomic fundamentals will turn more favourable in the medium term.

LOCAL CAPITAL MARKET PERFORMANCE

Treasury Bills

The Treasury bill auctions held in April 2025 reveal shifting investor sentiment amid Zambia’s high inflation environment. Demand for short-term government securities weakened

significantly between the two auctions, with total bids declining by 38.7% from K2,658.46 million in the first tender to K1,630.95 million in the second. This pullback was most pronounced in the 273-day tenor, where bids plummeted 78.9%, reflecting growing investor caution. While yields remained stable for 91-day (11.00%) and 182-day (12.00%) bills, the 273-day yield edged up to 13.00%, and the 364-day yield held steady at 14.50%. However, with inflation at 16.5%, all tenors continue to offer negative real returns, eroding investor purchasing power by 2.5% to 5.5% annually.

Despite these challenges, the 364-day bill attracted the strongest demand, accounting for 56% of total bids in the second auction. This suggests investors are favouring longer tenors to marginally mitigate inflation risks, though yields remain insufficient to offset rising prices. The government’s rejection of higher-yield bids, such as 364-day offers at 16.00%, shows a focus on containing borrowing costs, even at the expense of reduced auction participation. Narrower yield ranges for accepted bids further highlight tighter pricing controls, likely in response to subdued demand.

The persistence of negative real returns raises concerns about capital flight to alternative assets, such as foreign currencies or equities, which could further strain domestic liquidity. For the government, balancing yield attractiveness with debt sustainability remains a key challenge. Unless inflation moderates or yields adjust upward, investor appetite for Treasury bills may continue to weaken, potentially necessitating policy interventions to restore market confidence.

Government Bonds

The bond auction results for April 2024 and April 2025 reveal significant changes in investor demand, yields, and allocations across various tenors. In April 2024, the total amount offered was K1,600 million, with bids totalling K1,181.18 million and allocations reaching K1,172.38 million. By April 2025, the total amount offered increased to K1,800 million, while bids surged dramatically to K5,684.26 million, with allocations rising to K2,160 million. This indicates a substantial growth in investor interest, as the bid-to-offer ratio more than quadrupled year-over-year.

The yield and coupon rates for Zambian government bonds experienced significant percentage declines across all tenors from April 2024 to April 2025. The 2-year bond saw a 8.8% decline in yield (from 17.00% to 15.50%), while the 3-year bond dropped 17.5% (from 20.00% to 16.50%). Longer tenors saw even steeper decreases: the 5-year yield fell 23.6% (from 22.00% to 16.80%), the 7-year declined 19.6% (from 23.00% to 18.49%), the 10-year dropped 23.9% (from 24.97% to 19.00%), and the 15-year yield plunged 24.5% (from 26.50% to 20.00%). These sharp reductions indicate a broad-based easing of borrowing costs for the Zambian government and a shift in investor expectations.

The decline in coupon rates means investors are now subscribing to lower fixed interest payments on new bond purchases. For existing bondholders, this trend is positive as older bonds with higher coupons become more valuable in the secondary market, potentially generating capital gains if sold before maturity. However, new investors face diminished income streams, which may push them toward longer-dated or higher-risk assets to maintain

returns. The drop in yields also suggests that inflation expectations or default risks have moderated, making government debt a safer but less lucrative investment especially in times of high inflation such as these. Overall, while the lower rates reduce future returns, they may signal a stabilizing economy and greater investor trust in Zambia’s fiscal management.

The LuSE

As of April 2025, the Lusaka Securities Exchange All Share Index (LASI) stood at 16,649.26 points, reflecting a 1.7% monthly gain and a year-to-date increase of 7.8% . This upward trend indicates sustained investor confidence and positive market sentiment and an impressive15.3% year-on-year increase from 14,432.84 points in April 2024.

In April 2025, the Lusaka Securities Exchange (LuSE) recorded a significant uptick in market activity, with turnover reaching K121.8 million, a notable 44% increase from March’s K84.6 million. This surge made April the second month in 2025 to exceed the K100 million turnover threshold, signalling renewed investor interest and a possible rebound in trading confidence. Despite this strong April performance, overall trading activity in the first quarter of 2025 reflected a mixed picture. The total face value traded for Q1 stood at K5.2 billion, representing a slight 1% decrease from Q1 2024, while total turnover for the quarter came in at K382.5 million, a 9% decline year-on-year. For context, Q1 2024 had posted a turnover of K467.94 million, which itself was already 28.4% lower than Q1 2023. These figures underscore a longer-term downward trend in turnover, though the rebound seen in April 2025 offers cautious optimism for a potential market recovery in the months ahead.

ENERGY SECTOR

Petroleum Pump Prices

In April 2025, Zambia’s petroleum pump prices exhibited a mixed trend, reflecting both global market dynamics and domestic policy shifts. The Energy Regulation Board (ERB) reduced the diesel price by K2.31, bringing it down from K32.54 to K30.23 per litre—a 7.1% decrease. This reduction was primarily attributed to a 6.85% drop in international diesel prices, declining from US$89.58 to US$83.44 per barrel. Additionally, the implementation of the TAZAMA Open Access policy, which allowed multiple suppliers to utilize the TAZAMA pipeline, introduced competition and improved efficiency in diesel transportation, contributing to the price decrease.

Conversely, petrol prices remained unchanged at K34.98 per litre, despite a 7.26% decline in global petrol prices, from US$82.36 to US$76.38 per barrel. The ERB maintained these prices, citing a 0.98% depreciation of the kwacha against the U.S. dollar in March, which offset the benefits of lower international prices.

Comparatively, in April 2024, petrol was priced at K31.12 per litre, and diesel at K28.78 per litre. This indicates a year-on-year increase of approximately 12.4% for petrol and 5% for diesel. The higher petrol prices in 2025 reflect the cumulative impact of global oil price volatility and local currency depreciation over the year.

The introduction of the TAZAMA Open Access policy in 2025 marked a significant shift in Zambia’s fuel importation and distribution sector. By eliminating monopolistic control over the pipeline, the government fostered a more competitive environment, leading to cost reductions in diesel transportation and, consequently, lower pump prices.

Other developments

On the domestic front, ZESCO partnered with Zengamina Power to restore electricity in Ikelengi District after a gearbox fault at Zengamina’s hydro station. This collaboration not only addressed the immediate power outage but also marked the beginning of integrating Zengamina’s surplus power into the national grid, contributing to alleviating the country’s power deficit.

Efforts to improve regional energy cooperation also progressed. In April, Zambia and Mozambique signed a Memorandum of Understanding (MoU) to develop a gas pipeline from Beira to Ndola, aiming to transport up to 3.5 million metric tons of petroleum products annually. Furthermore, the Zambia-Tanzania Interconnector Project (ZTIP), backed by the World Bank, is set to enhance power transmission between the two countries, improving energy security and facilitating electricity trade in the region.

TRADE DYNAMICS

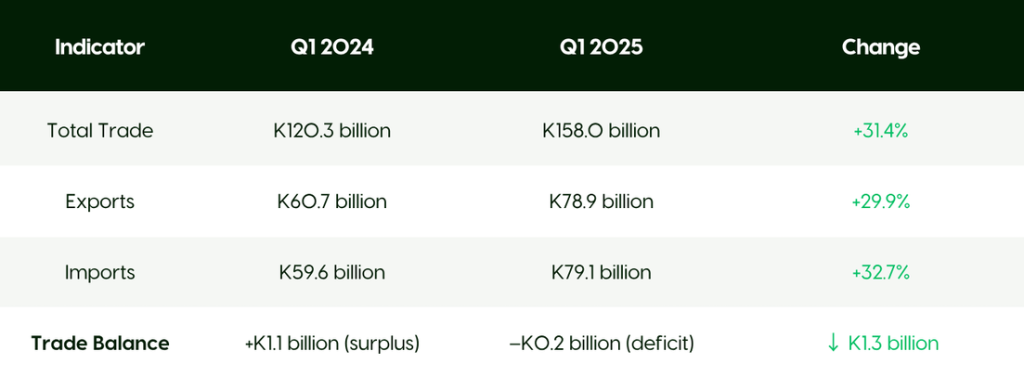

In the first quarter of 2025, Zambia’s trade dynamics exhibited significant growth compared to the same period in 2024. According to the Zambia Statistics Agency (ZamStats), total trade (the sum of exports and imports) from January to March 2025 reached K158.0 billion, marking a 31.4% increase from K120.3 billion recorded in the first quarter of 2024.

Exports for Q1 2025 totalled K78.9 billion, while imports stood at K79.1 billion, resulting in a marginal trade deficit of K0.2 billion. In contrast, the first quarter of 2024 saw exports amounting to K60.7 billion and imports at K59.6 billion, yielding a trade surplus of K1.1 billion. This shift from a surplus to a deficit indicates that while trade volumes have increased, imports have outpaced exports in growth, contributing to the current trade balance.

The surge in trade activity can be attributed to several factors. On the export side, there was a notable increase in the value of domestically produced goods, particularly in the mining

sector. However, the growth in imports was driven by heightened demand for capital goods and raw materials, reflecting ongoing infrastructure projects and industrial activities within the country. Additionally, fluctuations in global commodity prices and exchange rates may have influenced the cost and volume of traded goods.

Conclusion

The April 2025 data present an economy caught between persistent pressures and emerging opportunities. The numbers tell a clear story: while some sectors show resilience, fundamental challenges continue to weigh on Zambia’s economic outlook.

The inflation picture remains concerning, with food prices (18.7%) continuing to outpace overall inflation (16.5%), maintaining pressure on household budgets. The Basic Needs Basket’s 7.7% year-on-year increase to K11,417.99 starkly contrasts with average formal sector incomes of K7,731, highlighting the growing affordability crisis.

Currency markets show modest improvement but underlying vulnerabilities persist. While the kwacha recovered slightly to K27.93/USD by April’s end, its 4.6% depreciation year-on-year reflects ongoing structural weaknesses, particularly in export performance and foreign exchange reserves.

Capital markets present a mixed performance:

· Treasury bills struggle with negative real returns (yields of 11-14.5% vs 16.5% inflation)

· Government bonds see surging demand (bids up to K5.68 billion from K1.18 billion in April 2024)

· The LuSE shows surprising strength (15.3% year-on-year index growth)

Energy sector reforms begin showing results, with diesel prices falling 7.1% due to the TAZAMA Open Access policy. However, petrol prices remain elevated (12.4% higher than April 2024), reflecting the complex interplay of global markets and currency effects.

Trade dynamics reveal both progress and challenges. While total trade grew 31.4% to K158 billion, the shift from a K1.1 billion surplus to a K0.2 billion deficit signals growing import pressures that could strain the current account.

As Zambia moves forward, these April indicators suggest an economy at a crossroads. The coming months will test whether emerging strengths in bonds, equities and energy can outweigh persistent inflation and currency pressures. The data underscores that Zambia’s economic recovery remains fragile, with progress likely to be uneven across sectors.